January 31, 2019

|

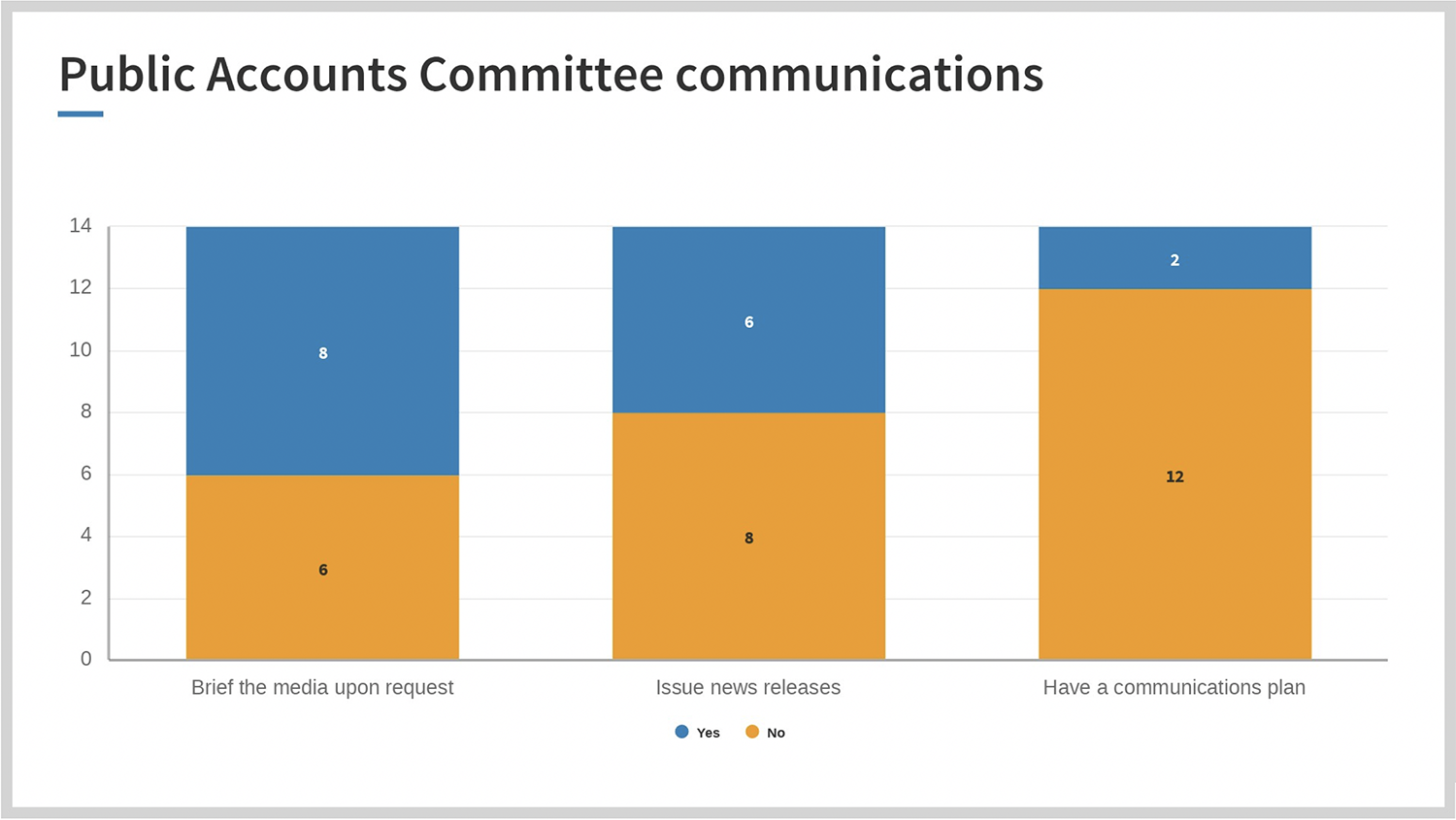

Public Accounts Committees (PACs) hold the government to account for how tax money is spent. To effectively carry out this role, a PAC should both operate under a supportive institutional structure and strive to continually improve its practices. This idea underpins the good practices identified in the recently published Canadian Audit and Accountability Foundation (CAAF) guide Accountability in Action: Good Practices for Effective PACs. The good practices in this guide are the culmination of years of research by CAAF into what makes PACs effective, and how they can take steps to improve their effectiveness, regardless of the environment in which they operate and the resources they have. To better understand how effective PACs in Canada are, CAAF carried out two surveys in 2018 of PAC clerks and members in all 14 federal/provincial/territorial jurisdictions in Canada. We received responses to the clerks’ survey from all 14 PACs and responses to the members’ survey from approximately one quarter of all PAC members. This article shares some preliminary results, which we hope will spur discussion on how PACs can take further steps to become more effective in a few key areas. These results were some of the most striking from the survey, and also formed the basis for a presentation delivered at the joint annual conference of the Canadian Council of Public Accounts Committees and the Canadian Council of Legislative Auditors in Charlottetown, Prince Edward Island, on 24 September 2018. A full survey report will summarize all of the findings. Communication with StakeholdersCitizens care about how their tax dollars are spent. The PAC’s role in improving the administration of public money can help the public better understand how government manages finances and can help improve accountability. To increase the public’s understanding of the PAC’s role and its activities, the PAC should have an established method to communicate with stakeholders. This could include:

Key findings from the surveys

How can PACs improve communication?

Cross-Party CollaborationPublic money has no party. The PAC cannot effectively ensure governments are good stewards of public resources when members are trying to score political points during committee meetings. To foster cross-party collaboration, PACs should try to find consensus or unanimity in their decisions and recommendations. What does partisanship look like?

Key findings from the members’ surveyResponses suggested that members may underestimate the impact of partisanship. When asked about partisanship issues, 12% of PAC members felt it was their role to advance their party’s policies. These respondents showed a partisan perspective to their work on the committee. When PAC members were asked whether they felt their PAC was hampered by partisanship, more than half agreed that it was. What is most telling is that when asked to identify barriers they saw to their committee’s effectiveness, 75% of members raised issues related to partisanship on the committee as hindering their effectiveness. Likewise, when members were asked to provide comments on whether their PAC has appropriate powers to fulfill its mandate, two thirds of commenters volunteered that partisanship inhibited their effectiveness. Conversely, when PAC members were asked to identify factors that contribute to them being effective, many used language such as “a constructive cross-party approach” or putting forward a “united effort.” How can PACs improve cross-party collaboration?

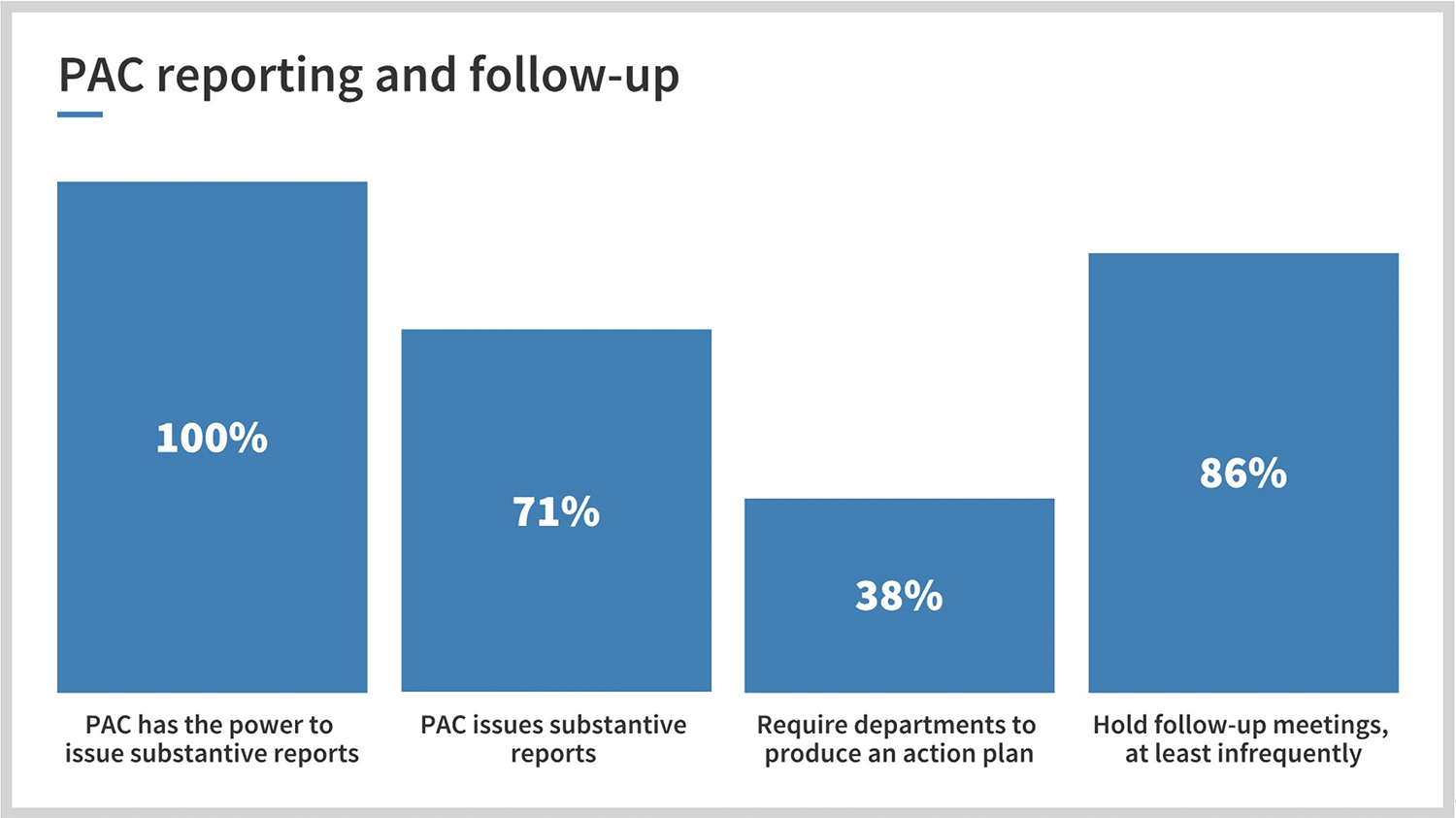

Reporting and Follow-upWithout follow-up there is no accountability. Follow-up provides an incentive for departments to implement recommendations and if they do not, they must justify their inaction to the PAC. Without follow-up, it is very difficult for a PAC to track its impact. A follow-up process is essential for improving financial management and the oversight of public money. Key findings from the clerks’ survey

How can PACs improve reporting and follow-up?

Although some of these recommended good practices for reporting and follow-up require resources that not all committees have, requesting action plans from departments only needs a minor committment from departments and provides significant insight into how audit recommendations are being implemented. A Final WordThese survey findings give us a picture of the state of PACs in Canada and provide the beginnings of a potential roadmap to improved effectiveness. We will share additional insights in a full survey report. You can learn more about our research into how PACs can improve or sustain their effectiveness in Accountability in Action: Good Practices for Effective PACs. |

Author

James Oulton, Deputy Director, Oversight, CAAF.

You can send your questions and comments on this article to the author at oversight@caaf-fcar.ca.